What is your small business exit strategy?

In the United States, it’s very easy to start a small business. Maybe too easy.

If you remember those early startup days, then you’ll also remember that very soon the easy part ended. Indeed, from the moment you transitioned from your initial capital to needing to generate the Holy Grail of capital – profit from sales to customers – things started getting really hard. And over the next few years, maybe decades, if running and growing your business ever got a little easier, it was only because you figured out how to do it without killing yourself.

Then, one year you started tinkering with the idea of, you know, actually leaving your baby. Tossing the keys to someone else and riding off into the sunset. You know – retiring. And the more serious you got about the idea, the more you realized you were entering another phase of business ownership that’s also really hard – selling a business.

Since it’s a natural law that every owner will one day exit his or her business for the last time, head first or feet first, I’ve consistently covered this topic on my radio program with exit strategy experts. Additionally, we’ve periodically asked the exit question in our weekly online poll. Comparing responses to the two most recent of these, five years apart, has been very interesting.

It was interesting that in both the poll this year and the one in 2013, about one-third chose the exit option, “I’ll sell my business.” The reason this response was interesting is because research has consistently shown that only about 20% of small businesses are actually sold. Alas, hope springs eternal.

After this, responses to the other three exit plan options diverged. For example, in 2013, about one-sixth of our respondents planned to convey the business to a family member. In 2018, that number was down by more than half (6%), which tracks with the anecdotal reporting: Millennials just don’t want to take over the business from their parents.

Next were those who’ve come to terms with the kiddos not wanting to work as hard as they did. The “I’ll just lock up one last time” group almost quadrupled over five-years, from 6% in 2013 to 23% now.

And finally, the folks who expect to be carried out of their businesses feet first dropped by a fifth, from half in 2013 to 39% in 2018. My take is that this cohort, likely mostly Baby Boomers, are increasingly deciding that retirement might not look so bad.

One insight into this last response option is that in 2013 we were in the middle of a lost decade in the economy, so some people probably felt they were going to have to work for the rest of their lives. But with the record level of optimism being reported from Main Street since December 2016 (NFIB, NAM, U.S. Chamber, our own polling), perhaps business owners feel their financial prospects have improved enough that they can entertain the notion of a classic retirement.

You know. Ride off into the Main Street sunset.

Write this on a rock … American Dream, thy name is small business owner, who’s never had it easy.

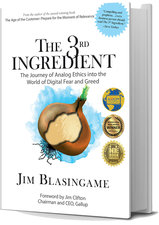

Jim Blasingame is host of The Small Business Advocate Show and author of the new book, The 3rd Ingredient: The Journey of Analog Ethics into the World of Digital Fear and Greed.